mississippi state income tax calculator

Add 1500 per dependent. Our calculator has been specially developed.

Income Tax Calculator 2021 2022 Estimate Return Refund

Mississippi tax year starts from July 01 the year before to June 30 the current year.

. Mississippi Salary Paycheck Calculator. Mississippis SUI rates range from 0 to 54. Income tax calculator Mississippi Find out how much your salary is after tax.

Your average tax rate is. You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202223. 2300 exactly 12 of the 4600.

Average Local State Sales Tax. Ad Enter Your Tax Information. Mississippi Income Tax Calculator 2021.

Also minors who earned more. The Mississippi State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Mississippi State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Mississippi State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state unemployment tax in full and on time you get a 90 tax credit on FUTA.

The Mississippi Department of Revenue is responsible for publishing. Mississippi state income tax. The Mississippi tax calculator is updated for the 202223 tax year.

Enter your gross income. See How Much You Can Save With Our Free Tax Calculator. Mississippi Salary Tax Calculator for the Tax Year 202223.

The following steps allow you to calculate your salary after tax in Mississippi after deducting Medicare Social Security Federal Income Tax and Mississippi State Income tax. Mississippi has a population of over 2 million 2019 and is known as the catfish capital of the United States. The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income.

You will be taxed 3 on any earnings between 3000 and 5000 4 on the next 5000 up to 10000 and 5 on income over 10000. Mississippi Hourly Paycheck Calculator. Optional Choose Normal View or Full Page view to altr the tax calculator interface to suit your needs.

Details on how to only prepare and print a Mississippi 2021 Tax Return. Real property tax on median home. Your average tax rate is.

Add 1500 per dependent or earned more than 16600 married. Mississippi state income tax returns for 2019 are due Monday April 15. Mississippi Income Tax Forms.

These back taxes forms can not longer be e-Filed. All other income tax returns. If you are receiving a refund.

Maximum Possible Sales Tax. How to Calculate Salary After Tax in Mississippi in 2022. The MS Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in MSS.

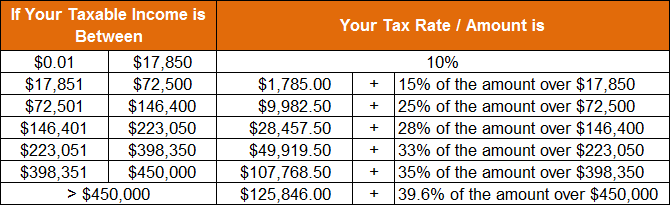

Married Filing Joint or Combined. The Mississippi income tax calculator is designed to provide a salary example with salary deductions made in. Filing 5000000 of earnings will result in 178500 of your earnings being taxed as state tax calculation based on 2022 Mississippi State Tax Tables.

If you make 72500 a year living in the region of Mississippi USA you will be taxed 12147. Just enter the five-digit zip code of the. Mississippi tax forms are sourced from the Mississippi income tax forms page and are updated on.

If you make 179840 in Mississippi what will your paycheck after tax be. Social Security - 9114. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate.

Maximum Local Sales Tax. In a Nutshell Due to the COVID-19 pandemic Mississippi has extended its filing and payment deadline for 2019 income taxes to May 15 2020. Free Federal Filing for Everyone.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. The median household income is 43529 2017.

Switch to Mississippi hourly calculator. Sales Tax State Local Sales Tax on Food. RE trans fee.

The 2022 state personal income tax brackets are updated from the Mississippi and Tax Foundation data. This results in roughly 9851 of your earnings being taxed in total although depending on your situation there may be some other smaller taxes added on. Calculate your Mississippi net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Mississippi paycheck calculator.

As a resident you are required to file a state income tax return if you had any income withheld for tax purposes earned more than 8300 single. Taxpayer Access Point TAP Online access to your tax account is available through TAP. 94 of farm-raised catfish in the nation are raised in Mississippi.

Although this is the case keep in. Mississippi Income Tax Calculator 2021. Mississippi does allow certain deduction amounts depending upon your filing status.

Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property and Registration Taxes and an Online Tool to customize your own personal estimated tax burden. The state capitol building dominates the Jackson Mississippi skyline at dusk. Mississippi State Income Tax Forms for Tax Year 2021 Jan.

State Income Tax - 8577. Medicare - 2608. Before the official 2022 Mississippi income tax rates are released provisional 2022 tax rates are based on Mississippis 2021 income tax brackets.

Things to know about filing a Mississippi state tax return. The taxable wage base in 2022 is 14000 for each employee. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. See What Credits and Deductions Apply to You. This Mississippi hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Below are forms for prior Tax Years starting with 2020. Mississippi State Sales Tax. Mississippi are 83 more expensive than Gautier Mississippi.

Below is listed a chart of all the exemptions allowed for Mississippi Income Tax.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Mississippi Income Tax Calculator Smartasset

Mississippi Tax Rate H R Block

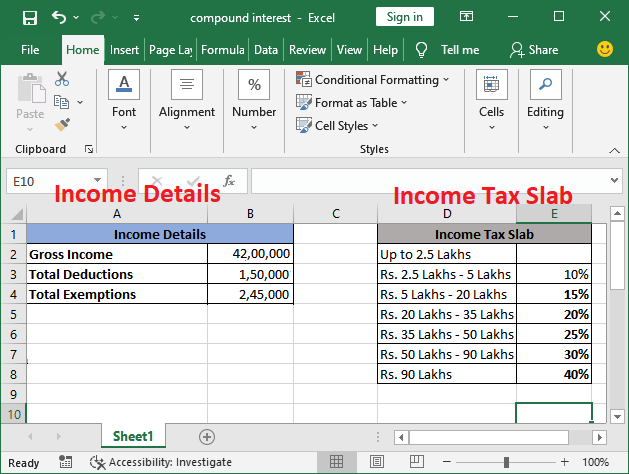

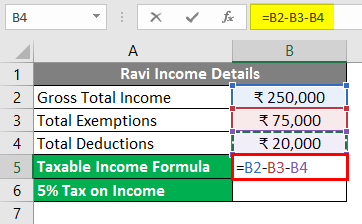

Income Tax Calculation Formula With If Statement In Excel

How To Create An Income Tax Calculator In Excel Youtube

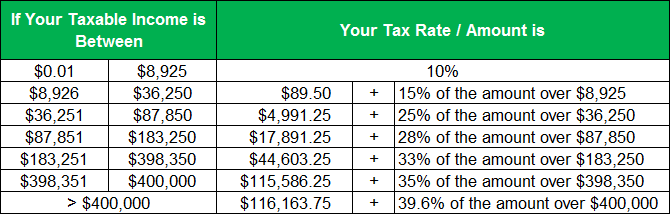

Complete Tax Brackets Tables And Income Tax Rates Tax Calculator Market Consensus

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

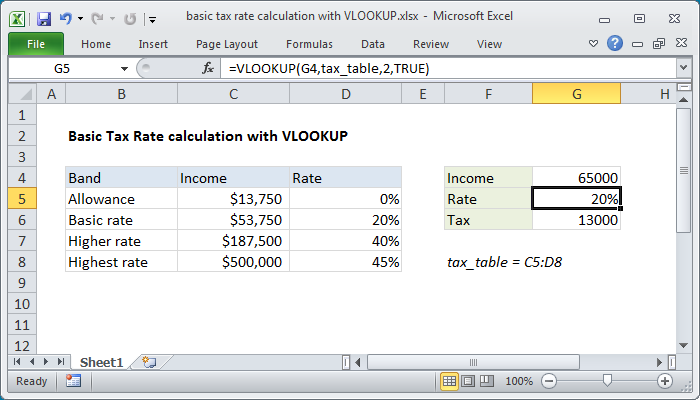

Excel Formula Income Tax Bracket Calculation Exceljet

Complete Tax Brackets Tables And Income Tax Rates Tax Calculator Market Consensus

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Mississippi Tax Rate H R Block

Income Tax Calculator Estimate Your Refund In Seconds For Free

How To Calculate Income Tax In Excel

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet