car lease tax california

This publication is designed to help motor vehicle dealers understand Californias Sales and Use Tax Law as it applies to the sale lease or use of a vehicle. Its good in that you are only responsible for the part of the car you actually use.

How To Buy Or Lease An Electric Car Advice From Owner Who S Done It Four Times

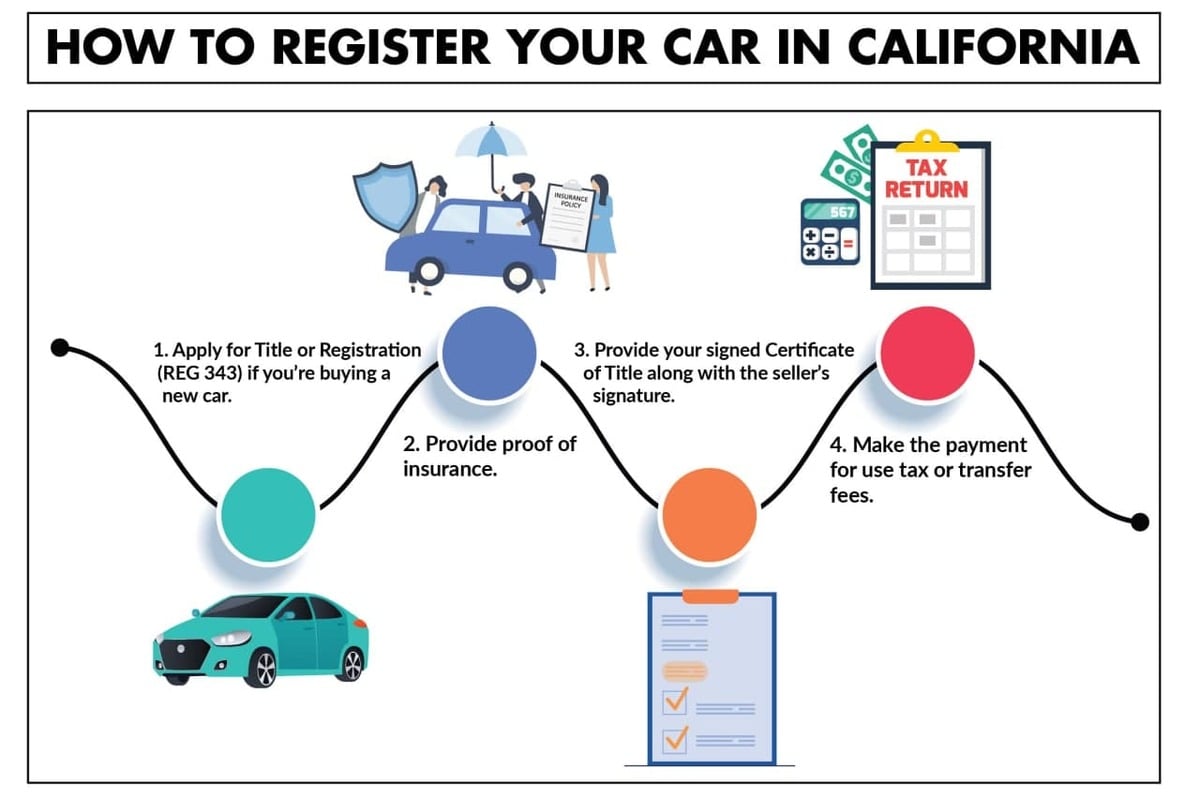

The buyer must pay sales tax to the California Department of Motor Vehicles upon registration of the vehicle.

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

. Save up to 30 with Secret Lease Offers. Leases limit the number of miles you may drive the vehicle often 12000 to 15000 miles per year. Multiply the base monthly payment by your local tax rate.

Say Hello to the 2022 Thrill Lineup Nissans Vehicles on the cutting edge of Thrill. For questions about filing extensions tax relief. Businesses impacted by recent California fires may qualify for extensions tax relief and more.

The California State Board of Equalization Board has promulgated Regulation 1660 which explains the law as it applies to leased property in general and transactions that may look like leases but are actually outright sales. Under the California Code vehicle lessees have a legal right to terminate their vehicle lease agreements before the scheduled date of expiration. Its sometimes called a bank fee lease inception fee or administrative charge.

Since the lease buyout is a purchase you must pay your states sales tax rate on the car. When you purchase a car you pay sales tax on the total price of the vehicle. 20000 X 0725 1450.

It is dated 62322 on the title they sent even tho Mercedes sent it a month late. CDTFA public counters are now open for scheduling of in-person video or phone appointments. Of this 125 percent goes to the applicable county government.

Local governments such as districts and cities can collect additional taxes on the sale of vehicles up to 25 in addition to the state tax. A car lease acquisition cost is a fee charged by the lessor to set up the lease. When you lease a car you may pay a small monthly use tax on the lease depending on your state or local tax rate.

Please contact the local office nearest you. For example if you previously paid 1500 sales or use tax to another state for the purchase of the vehicle and the California use tax due is 2000 the balance of use tax due to California would be 500. Please visit our State of Emergency Tax Relief page for additional information.

Beginning January 1 2021 certain used vehicle dealers are required to pay the applicable sales tax on their retail sales of vehicles directly to the Department of Motor Vehicles. While Californias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Acquisition Fee Bank Fee.

Its bad in that you pay tax not only on the price of the car but the lease fees as well. There is also a 50 dollar emissions testing fee which is applicable to. I had a question regarding the sales tax of a car that was a lease and I recently purchased it for 50k.

I am selling the. Information about vehicle repairs and the sale and use of parts is provided in publication 25 Auto Repair Garages and Service Stations. If you dont buy the vehicle at the end of the lease you may have to pay a disposition fee to return the vehicle.

The act governs transactions between vehicle lessors and lessees. Multiply the vehicle price before trade-in or incentives by the sales tax fee. Making the distinction between a true lease or sale at the outset is crucial because for sales the tax must be.

Pick Local Dealers Find Secret Specials. In California leases of tangible personal property are generally subject to use tax unless you pay sales tax reimbursement or use tax at the time of purchase of the property or you timely elect to pay use tax based on the purchase price and lease the property in substantially the same form as acquired. For example if a lease on a Mercedes-Benz E-Class has a monthly price of 699 before tax and your sales tax rate is 6 the monthly lease tax is 4194 in addition to the 699 base payment.

The bank or leasing company may not charge or collect the tax on the sale of the leased vehicle ie the lease buyout amount. This page describes the taxability of leases and rentals in California including motor vehicles and tangible media property. This makes the total lease payment 74094.

Ad Tech that changes every part of your drive with performance efficiency for the win. Revisit the dealership that sells the vehicle you wish to lease. If you cannot find the information you are.

The minimum is 725. According to the Sales Tax Handbook the California sales tax for vehicles is 75 percent. The car buyer is responsible for paying VAT during a private car sale.

Section 2987 of the California Civil Code is the Moscone Vehicle Leasing Act. For example imagine you are purchasing a vehicle for 20000 with the state sales tax of 725. In CA tax is paid on the payment.

8 and AB 82 Stats. Application of Tax to Leases. On June 29 2020 California passed Assembly Bill AB 85 Stats.

Add Sales Tax to Payment. I received the title that is I think signed so that I can take to DMV and register it under my name. California collects a 75 state sales tax rate on the purchase of all vehicles of which 125 is allocated to county governments.

Sales tax of a leased car in california. If you go over the miles allowed you will be charged for the extra miles at the end of the. The acquisition fee will range from a few hundred dollars to as much a 1000 for a higher-end luxury car.

However lessees can charge them reasonable fees for. 1450 is how much you would need to pay in sales tax for the vehicle regardless of if it was used purchased with. Request a Lease Quote on Any Car.

Answer 1 of 2. If you buy a vehicle for 12000 and trade in your old vehicle for 6000 you will still have to pay taxes on the 12000 for which the car was originally sold. Negotiate a sales price for the vehicle with the car salesman aiming for the lowest price possible starting from the wholesale car priceKeep sales taxes in mind as California sales taxes can raise the final cost of the car significantly ranging from 725 percent in areas like Ventura or Yuba counties to as.

To learn more see a full list of taxable and tax-exempt items in. Things to consider before leasing. Ad Find Car Leases Online Low Prices.

This is good and bad. When you purchase a car you pay tax only o. As of September 2011 Oregon Alaska New Hampshire Montana.

Is Your Car Lease A Tax Write Off A Guide For Freelancers

California Vehicle Sales Tax Fees Calculator

/is-a-high-mileage-lease-right-for-me-527161_FINAL-a6fc1fa14dd246cd93c63cf8d96bd931.png)

Is A High Mileage Lease Right For Me

How Does Leasing A Car Work Earnest

Is It Better To Buy Or Lease A Car Taxact Blog

Consider Selling Your Car Before Your Lease Ends Edmunds

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

Moving To California Driver S License And Car Registration

Is Your Car Lease A Tax Write Off A Guide For Freelancers

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

4 Ways To Calculate A Lease Payment Wikihow

Is Your Car Lease A Tax Write Off A Guide For Freelancers

What S The Car Sales Tax In Each State Find The Best Car Price

Is It Better To Buy Or Lease A Car Taxact Blog

End Your Car Lease Early Sell Swap Or Buy Nerdwallet

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price